Posts

The newest 2x Citi ThankYou Advantages Issues gained equates to an approximately step three.2% go back on the using, that’s big for purchases outside of extra categories. You will find an introduction balance import payment from 3% of each import (lowest $5) accomplished in the basic cuatro days of membership starting. Following, the percentage was 5% of every transfer (minimal $5). Citi have turned the newest Twice Bucks card to your a top alternatives for those who are trying to find a normal, no-fool around mastercard. Around $600 from cellular telephone shelter up against destroy or thieves.

- You can purchase as much as $800 for each and every allege or over in order to $step 1,000 a-year, that have a total of a few claims inside the a good 12-week period.

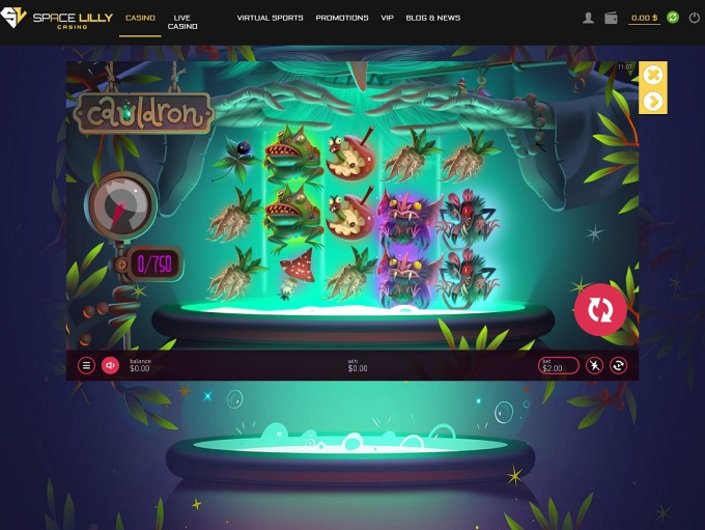

- For example, i always look at points including the online casino’s licensing and protection, game variety, payment procedures, and you can user experience.

- Mobile FeliCa use Sony’s FeliCa technology, and that is the new de facto simple to have contactless wise notes in the country.

- You additionally can explore a virtual critical providing charge card control choices due to a browser.

- Someone else is also’t use your phone number in order to fraudulently deposit currency within their account both, because they need to have your own mobile to help you do it.

He is right for profiles who have particular criteria. You will now find your order realization, giving you an introduction to all the items we want to mrbetlogin.com Visit Website order, plus the picked percentage strategy. So you can explore Mobile Percentage, click on the “confirm acquisition” option. Terms, criteria, cost, bells and whistles, and you will services and you will support alternatives subject to changes without warning. Sure, you need a wi-fi connection to use the GoPayment app and you may credit audience. Which means you stick to better from sales, even although you don’t feel the credit audience.

For each and every website are certain to get a list of payment steps, and you may take a look at these types of at the cashier. Listed here are some well-known options you can use to pay for your own gambling establishment membership. Rather than a cover because of the cell phone option, most of these steps and allow you to generate withdrawals.

As to why Buy A keen Unlocked Cell phone?

If you’re able to’t spend the declaration equilibrium completely, attempt to pay as often of the bank card equilibrium that you could. For those who just make minimal payment on your charge card, it may take you a lifetime to settle your financial situation—specifically if you’lso are stuck with high interest rates. The best way to build a charge card payment should be to install autopay on the web. Reducing your balance helps you reduce your borrowing from the bank utilization ratio, which is the next the very first thing you to gets into their credit score. Each time you build a fees in your credit card the borrowing from the bank usage proportion tend to decrease, which could provide your credit score a boost.

Shell out Monthly Devices

Let’s view a few of the better-rated team, using their fees on their terminal choices. Merchants pay just 1.95 percent for every deal, and no chargebacks. You can check out more information during these notes as well as their coverage within our full list of cards offering portable shelter. Individuals who need a rewards-getting travelling cards that provides mobile defense you’ll enjoy the Wells Fargo Autograph Excursion. The newest card does not have any the best generating speed with this number, however the smartphone defense benefit could save you more from the longer term than the advantages you would earn together with other cards. Is considered the most a lot of Amex cards which provides mobile phone defense which can be probably one of the most financially rewarding advanced cards to your the marketplace.

Multiple investment also offers is generally offered at checkout. Applications to own financing try susceptible to qualification, credit acceptance, county abode limits, or other certification. As low as costs don’t echo those investment offers. Get your cell phone percentage which have low costs that suit your own spend agenda you wear’t have to worry about missing a fees. By enabling offline payments, you are responsible for people ended, rejected, or debated costs accepted when you’re offline.

Shell out From your Mobile phone

In the event the all of your company is held on the go, for example regarding a tradesperson/contractor, there is certainly virtually no benefit inside searching for a card reader because the an app is more compatible. As long as your cell phone try working, you could take on payments anyplace, each time. It means your instalments taken because of the a software like the Costs Software on your new iphone 4 otherwise Android os cellular telephone can help you properly and you may safely for your requirements as well as your users. The brand new software enables tap-and-go money, guidelines admission of credit information or sending out of an installment request. Simply tap the customer’s credit against your own mobile otherwise tablet and the percentage try canned instantaneously.

Look at the to buy electricity to see the fee alternatives on the hand of one’s hands. Purchase today, pay later which have versatile arrangements that fit your budget. And take Affirm every where, which means you never ever spend undetectable charge otherwise material desire.

Paying To the T

So you could enter a store that’s electronic payment friendly but nonetheless have to use your own bank card. Including, Walmart accepts mobile repayments, however, simply from the own Walmart Spend platform, and that simply works from the Walmart. Very mobile purses allow you to put shop commitment otherwise benefits notes. When you create a cellular pick using credit cards in the the newest handbag, it will immediately link the acquisition to the rewards system. Thus, you get all of the benefits of a rewards programwithout being required to bring the newest cards on your own wallet.